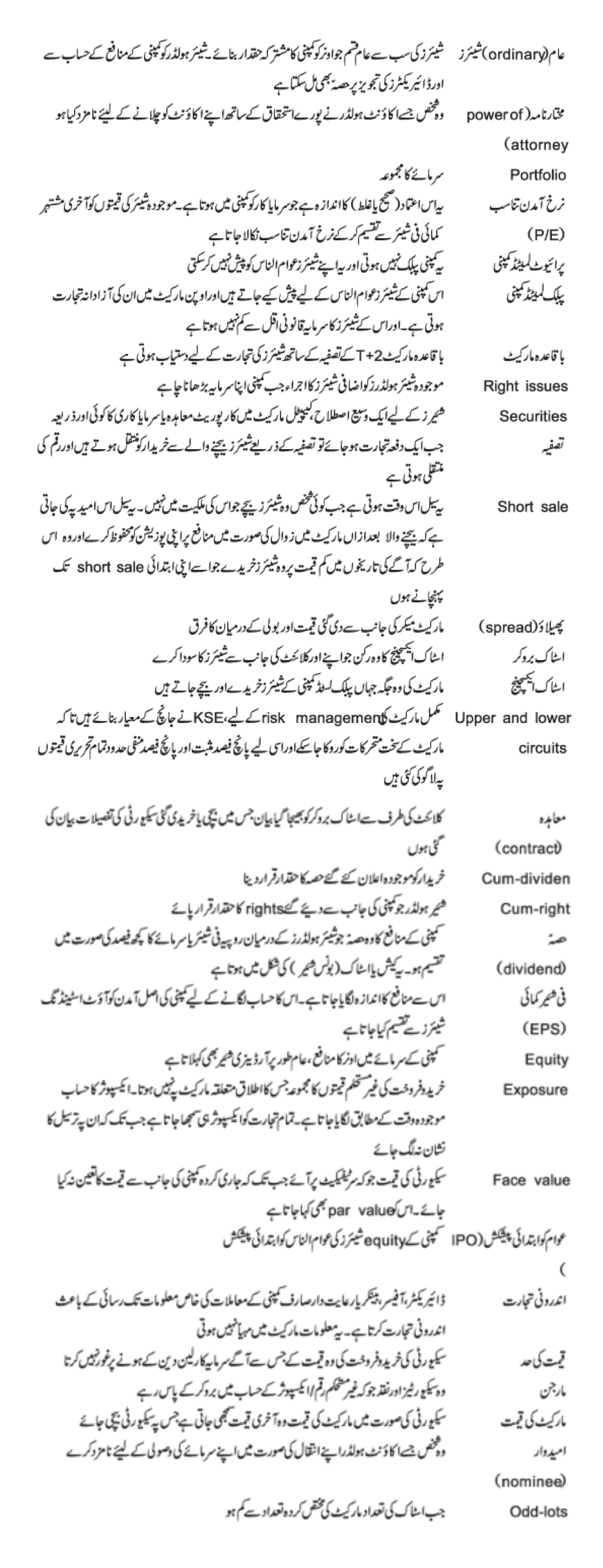

| Terms |

Explanation |

| Annual Report |

Formal financial statements, the Auditors’ Report, together with the Directors’ Report issued by a company. These financial statements are usually prepared at the close of the company’s financial year. |

| Arbitrage |

The simultaneous purchase and sale of the same security on different stock exchanges at prices which yield a profit. |

| Bear |

An investor who anticipates for a decline in stock prices. |

| Bear Market |

A market in which stock prices are declining in general. A serious decline is called a depression. A short decline in a generally rising market is looked upon as a technical correction. |

| Bid and Ask |

The bid is the highest price any one has offered to pay for a security at a given time; the asked is the lowest price any one has offered to accept for a security at a given time. |

| Blue Chip |

A large well-established company with a history of profitable operation. |

| Book Closing |

The closure of books by a company to determine the shareholders’ rights to receive bonus, dividend, rights, etc. No transfers are recorded during this period. |

| Boom |

Denotes greater activity on the stock exchange |

| Bull |

An investor who anticipates for a rise in stock prices. |

| Bull Market |

A market in which stock prices are rising in general. If the market is recovering from a deep decline, the early stage of the uptrend is called an up reversal, turnaround, rally or recovery. |

| Capital Gain/ Loss |

Profit or loss arising from the sale of securities. |

| Capital Gain tax |

Tax payable on profit arising from appreciation in value of investment, realized at the time of selling or maturity of investment. |

| Clearing |

Settlement or clearance of dues accounts in stock exchanges. |

| Collateral |

Securities or other properties pledged by a borrower to secure the repayment of a loan. |

| Commission |

The fees payable by a client to the stock broker for trading in securities on his behalf. |

| Contract |

A statement sent to a client by the stockbroker, giving details of securities purchased or sold. |

| Cum-dividend |

The term implies that the buyer is entitled to the dividend currently declared. |

| Cum-right |

Shares having the right to receive the upcoming rights issues offered by the company. |

| Dividend |

That part of a company’s profits which is distributed among shareholders, usually expressed in rupee per share or percentage to paid up capital. It could be in the form of cash or stock (Bonus Share). |

| Earnings per Share (EPS) |

A profitability indicator calculated by dividing the net after tax earnings available to common stockholders during a period by the average number of shares outstanding at the end of that period. |

| Equity |

The owners’ interest in a company’s capital usually referred to as ordinary shares. |

| Exposure |

Aggregation of unsettled amount of purchases and sales under each Market with no netting applicable to respective Market. The exposure is calculated using real-time values. All trades are counted as exposure unless they are marked for delivery. |

| Face Value |

The value of a security that appears on the face of the certificate unless the value is otherwise specified by the issuing company. It is also termed as par value. |

| Initial Public Offering (IPO) |

The offering of equity shares of a company to the general public for the first time. |

| Insider Trading |

Insider trading normally occurs when an insider, that is, a director, an officer, a banker or a favored customer, due to his access to special information about the company’s affairs, which has not been made available to the market influence the value of shares to his advantage. |

| Limit Price |

The price beyond which an investor would not consider executing a transaction involving the purchase or sale of securities. |

| Margin |

Securities and cash held with broker against any outstanding unsettled amount/exposure |

| Market Price |

In case of a security, market price is usually considered the last reported price at which the security is sold. |

| Nominee |

An individual who is designated by the account-holder to receive all cash and custody in case of the account holder’s demise. |

| Odd-Lots |

A quantity of stock less than the established/ allowed unit of trading in regular market. |

| Ordinary Shares |

The most common form of shares, which entitle the owners to jointly own the company. Holders may receive dividends depending on profitability of the company and recommendation of directors. |

| Power of Attorney |

An individual who is designated by the account-holder to operate the account with the same privileges as the account holder. |

| Portfolio |

A collection of investments. |

| Price/Earnings Ratio (P/E) |

The P/E ratio is a measure of the level of confidence (rightly or wrongly) investors have in a company. It is calculated by dividing the current share price by the last published earnings per share. |

| Private Limited Company |

A company that is not a public company and which is not allowed to offer its shares to the general public. |

| Public Limited Company |

A company whose shares are offered to the general public and traded freely on the open market and whose share capital is not less than a statutory minimum. |

| Regular Market. |

Regular market available for shares trading with regular settlement of T+2. |

| Right Issue |

The issue of additional shares to existing shareholders when companies want to raise more capital. |

| Securities |

A broad term for shares, corporate bonds or any other instrument of investment in the capital market. |

| Settlement |

Once a trade has been executed, the settlement process transfers shares from seller to buyer and arrange the corresponding exchange of money between buyer and seller. |

| Short Sale |

It occurs when a person sells shares that he does not own. A short sale is usually made in the hope that a subsequent market decline will enable the seller to ‘cover his position’ at a profit, that is, to buy at a later date and at a lower price the shares he needs to deliver against his original short sale. |

| Spread |

The difference between the bid and offer price of a market maker. |

| Stock Broker |

A member of the stock exchange who deals in shares for his own and behalf of clients. |

| Stock Exchange |

The market place where shares of public listed companies are bought and sold. |

| Upper & Lower Circuits |

For overall market risk management, the KSE has built in checks to curb drastic market movement, and has placed a 5% positive and negative limit on all scrip prices. |